The R&D tax credit : latest news

At EPSA USA, we specialize in helping innovative companies of all sizes optimize their R&D Credit claims.

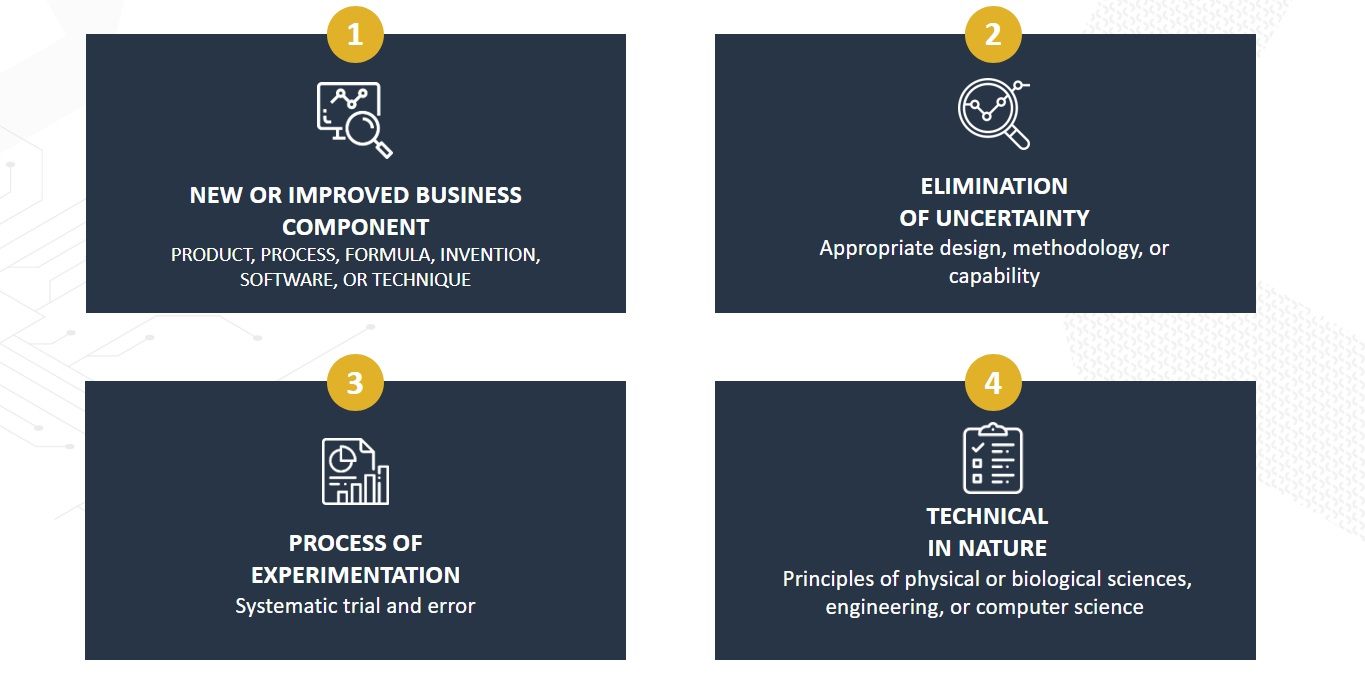

Many companies do not think they can take advantage of the R&D credit because they don’t believe they do R&D.

The definition in the Tax Code (Section 41) is actually pretty broad and if a firm is improving or developing a Product, Process or Software that is technical in nature, they likely are eligible.

Want to learn more? Sign up to receive a complimentary guide to R&D!

Sign up to get your complimentary assessment!