174 Amortization

What was Section 174 ?

For tax years beginning before 1/1/2022, Section 174 was a flexible provision that allowed companies to deduct eligible Specified Research and Experimental (“SRE”) expenditures from taxable income in the year incurred or capitalize and amortize over a period of at least 60 months

What has changed about Section 174 and why does it matter?

For tax years beginning on or after 1/1/2022, §174 is a more rigid tax provision that requires companies to clearly identify SRE expenditures and capitalize/amortize those costs over time. This change increases a company’s taxable income and discourages R&D investment.

Taxpayers are now required to distinguish all §174 costs from other categories, even if similar costs were previously eligible for multiple tax treatments.

-

Ability to immediately deduct costs is eliminated.

-

§59(e) election and special treatment for software development are both eliminated.

-

All §174 costs, including software development, must be capitalized, and amortized over 5 years (15 years for foreign research costs).

-

The mid-year convention only allows half a year of amortization in the first and final years.

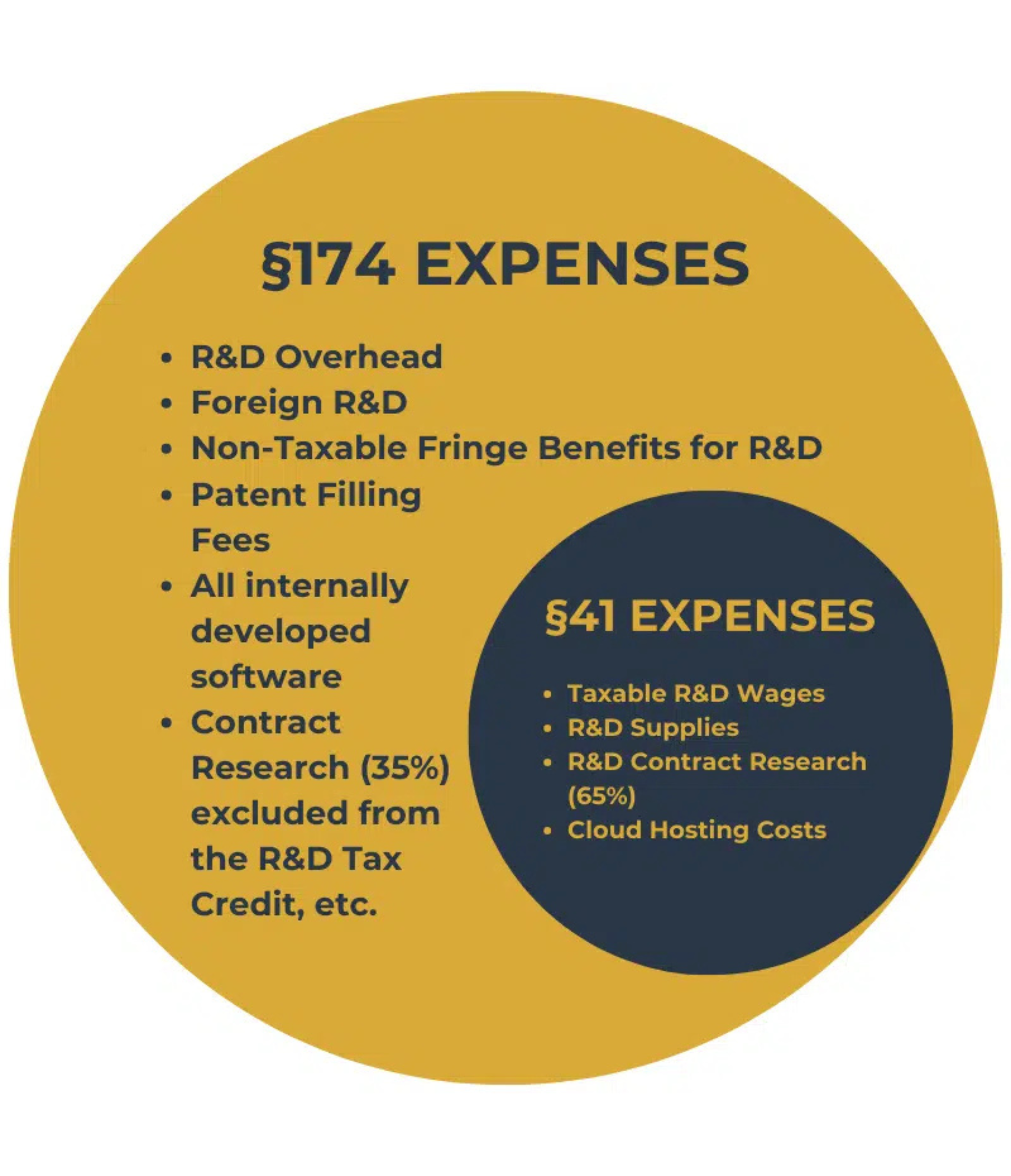

R&E Deduction (§174) vs R&D Tax Credit (§41)

Deduction

A tax deduction reduces your taxable income, which, in turn, lowers the amount of income subject to taxation.

Credit

A tax credit is a direct reduction in the amount of taxes you owe. It reduces your tax liability dollar for dollar. §174 deals with the deduction and amortization of research and experimental (R&E) expenses, while §41 addresses the research and development (R&D) tax credit. They are related in the sense that they both pertain to research expenses, but they serve different purposes and operate independently of each other.

Who is impacted by these changes?

Section 174 is a tax provision that requires ALL taxpayers that have research and experimental (“R&E”) expenses to capitalize/amortize those expenses. Whether a taxpayer has $10,000 in R&E expenditures, or $100 million, the costs must be capitalized.

Many taxpayers in a wide range of industries are impacted, including, but not limited to, the following:

- Pharmaceutical and Biotechnology

- Technology and Software Development

- Aerospace and Defense

- Automotive

- Telecommunications

- Architecture and Engineering

- Manufacturing

- Consumer Electronics

- Healthcare and Medical Devices

- Food and Agriculture

- Government and Defense Research Agencies

- Chemical and Materials Science

- Environmental and Sustainability.

Contact us today

Our tax experts are well-versed in identifying and documenting qualifying research and experimental as well as research and development activities that are eligible for tax deductions and credits. This knowledge is crucial for determining which expenses can must be considered under the new §174 amortization requirements. §174 of the Internal Revenue Code pertains to the deduction and amortization of research and experimental expenditures, making it closely related to the R&D tax credit.

Steven Latchin

slatchin@epsa.com

Sam Wenden

swenden@epsa.com

Q&A about §174 amortization requirements

-

What are examples of 174 research and experimental expenditures?

Expenses incurred in connection with the taxpayer’s trade or business which represent research and development costs in the experimental or laboratory sense. These include but are not limited to, patent fees, computer software development costs, labor, materials and supplies, cost recovery allowances, travel costs, operation, and management costs such as rent, utilities, etc.

-

If I don't take the R&D tax credit, do I have to worry about amortizing 174 expenses?

Yes, regardless of if you are, have not, or plan to claim the R&D tax credit, the amortization of 174 expenses for any company with any SRE expenses is still required.

-

Can I opt out of 174 amortizations if I don't claim the R&D credit?

TCJA removed the option to expense SRE expenditures, it is now a requirement for all taxpayers to capitalize and amortize these expenditures.

-

Is this going away anytime soon?

There are many organizations and state officials working to overturn this, however, the IRS is planning to provide more specific guidance regarding the new section 174 changes by the end of November 2023. Therefore, we do not foresee any overturn any time soon and advise clients to consult their tax advisors.

-

Which entities are subjected to Section 174 capitalization?

Any taxpaying entity that incurs qualifying SRE expenditures independent of specific industry or business size. There are several types of businesses that are impacted, including Corporations, small businesses including startups, sole proprietorships, partnerships, LLCs, past-through entities including S-corporations.

-

Is it still worth claiming the R&D credit with the new Section 174 amortization requirements?

EPSA’s opinion is yes. Section 174 amortization is required regardless of if you decide to claim the R&D credit. Since Section 174 amortization is likely to increase taxable liability, the R&D credit can help offset some of that.

Review this one-page summary and take it home with you

Download our 174 one-pager to access comprehensive information about qualification criteria and eligibility.

Discover our solutions to benefit tax credits and incentives

With our team of local experts, EPSA USA is focused on helping companies of all sizes take advantage of the Research and Development Tax Credit at both the federal and state level.

Our technical and legal experts follow IRS guidelines to identify qualified research expenses that dictate eligibility.

We work hand-in-hand with CPAs, clients, and partners to offer tailored solutions to identify R&D Tax Credits. Our streamlined process is efficient, fast, and guaranteed to optimize tax benefits for a variety of industries.