Are you a new software or technology company paying thousands of dollars in payroll tax? Are you still in the beginning phases of your development process? We may have a way to help reduce those payroll expenses!

The R&D Credit was made permanent as part of the Protecting Americans from Tax Hikes (PATH) Act of 2015. Prior to the PATH Act, the R&D credit could only be used to offset income tax liability for a corporation or shareholder/partner. Now, thanks to the PATH Act, “new or small businesses” can use the R&D credit to offset up to $250,000 of the employer portion of its social security tax per year for ALL employees, not just the employees engaged in R&D. This offset comes with a direct impact on your cashflow, P&L and therefore EBITDA for all years you are eligible. A “new or small business” is defined as a company that has generated gross receipts for five years or less and the gross receipts are less than $5 million in the current year.

There are a few key things to consider when determining your company’s eligibility:

- Bank interest income is included when determining whether a company has gross receipts in a given year.

- To offset payroll tax, the R&D credit must be claimed and filed on an original tax return. It cannot be used to offset payroll tax if it is filed on an amended return.

- If the company is new, the gross receipts must be less than $5 million after being annualized for a full 12-month period.

- If the “new or small business” shares common ownership with another entity, the gross receipts must be combined from all businesses when determining eligibility.

Based on our experience, this is a HUGE win for small businesses, especially new software and technology companies. Our experts have helped hundreds of software and technology companies claim the R&D credit and can work with you and your CPA to make ensure the credit is calculated and filed properly.

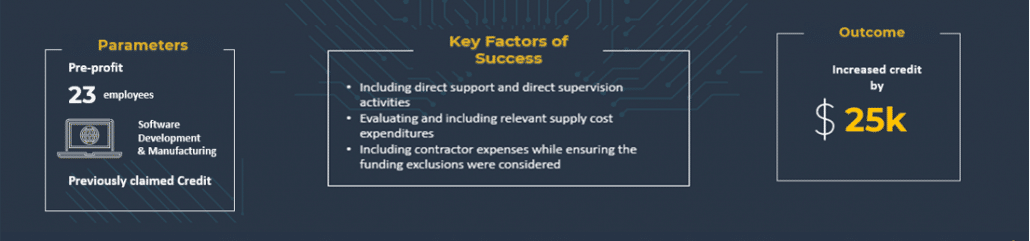

As an example, below is a snapshot of a client we recently helped claim $47,000 in R&D tax credits that it then used to offset its payroll tax the following quarter. This allowed them to bring on additional employees to assist in the improvement of its mobile application.

Interested in an assessment? Enter your company information here and one of our experts will get back to you within 48 hours!