Discover how investments in energy efficiency improvements can drive significant cost savings for commercial and residential building owners.

By Alexis Martin.

As the world confronts the urgent challenges posed by climate change and rising energy costs, businesses are increasingly seeking sustainable solutions to enhance operational efficiency. Among the available strategies, the Section 179D deduction emerges as a critical financial incentive for investing in energy-efficient improvements of commercial and residential (four stories and higher) buildings. This provision of the Internal Revenue Code not only promotes sustainable practices but also delivers substantial tax savings, enabling organizations to offset costs associated with upgrading to greener technologies.

The United States is actively addressing climate change through significant measures to reduce greenhouse gas emissions and promote sustainable practices. One of the most impactful initiatives is the Inflation Reduction Act (IRA), which provides substantial tax incentives for clean energy investments. This legislation supports renewable energy tax credits, as well as investment deductions for efficiency improvements, encouraging both businesses and consumers to adopt greener technologies.

WHY IS THE 179D A GREAT INCENTIVE TO PROMOTE GREEN BUILDINGS?

The IRA significantly enhances clean energy investment and mitigates climate change through improved tax incentives. A standout feature of this legislation is the expansion of IRC Section 179D, which provides tax deductions for energy-efficient improvements in buildings. The core principle of Section 179D is to incentivize investment in energy-efficient technologies and design, mainly in the Building Envelope and Building Systems (HVAC and Lighting), thereby promoting resource efficiency and sustainability.

With the IRA, the deduction allows property owners and design professionals (Architecture and engineering firms) to deduct up to $5.36 per square foot in 2023, and up to $5.65 for 2024 for qualifying energy-efficient upgrades, a significant increase from the maximum $1.88 per square foot in 2022.

This significant financial incentive encourages businesses to make capital investments that reduce energy consumption. Notably, the IRA has made it easier for businesses to qualify by lowering the required increase in energy efficiency from 50% to just 25% of the 2007 standards of the American Society of Heating, Refrigeration, and Air-Conditioning Engineers (ASHRAE). This shift aims to broaden participation and drive a larger number of commercial building upgrades, effectively aligning financial incentives with essential environmental goals.

Furthermore, the deduction’s structure facilitates immediate tax savings, which is increasingly vital as businesses face rising operational costs and fluctuating energy prices. By offsetting the initial costs of adopting energy-efficient technologies, the Section 179D deduction plays a crucial role in supporting businesses in their quest for sustainability while also contributing to a greener economy.

HOW CAN BUILDING OWNERS BENEFIT FROM THE 179D DEDUCTION?

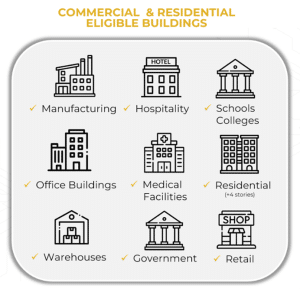

Building owners stand to gain significantly from the Section 179D deduction, particularly when they have invested in or plan to invest in new construction, renovation, or extension projects of energy-efficient commercial and residential buildings. This applies to any manufacturing, warehousing, or office buildings, as well as retail shops, malls, hotels, schools, or hospitals.

In certain cases, other parties can benefit from this deduction. If the tenant, rather than the owner, invests in energy efficiency upgrades, they can claim this deduction. Additionally, if the building owner is a tax-exempt entity, such as a government or non-profit organization, the deduction can be assigned to the primary designer, the architectural firm, or the MEP (Mechanical, Electrical, and Plumbing) engineering firms involved in the building’s design.

The financial implications can be substantial. This tax incentive not only supports the immediate economic health of firms but also enhances their competitive edge in the growing market for sustainable building solutions.

By integrating energy-efficient designs into their projects, building owners can improve their bottom line and also demonstrate a commitment to sustainability. This proactive approach can attract environmentally conscious clients and tenants, further differentiating these buildings in a competitive landscape.

WHY IS NOW THE RIGHT TIME TO EXPLORE THIS OPPORTUNITY?

Building Owners should act swiftly to leverage the 179D Deduction for 2023 and 2024. The current qualification requirements are relatively straightforward, but this won’t last—after 2026, energy efficiency standards will tighten under the 2019 ASHRAE guidelines, making it harder to secure the full deduction. Additionally, the deduction amount has nearly tripled for 2023 and 2024, offering a substantial increase in benefits. Another crucial factor is that the Prevailing Wage and Apprenticeship (PW&A) requirements are waived for projects that began before 2023. Future projects will have to meet these requirements to fully capitalize on the deduction.

Claiming the Section 179D deduction involves several essential steps: ensuring compliance with energy savings standards through a neutral third party, conducting energy modeling to verify the improvements, and completing the final technical documentation to substantiate the deduction according to IRS guidelines, which finally includes submitting tax form 7205.

Alexis Martin is CEO of EPSA USA, a Philadelphia-based firm that specializes in credits and incentives.

You can contact him or his team for an assessment by email at [email protected] or by phone at (917) 495-5746.