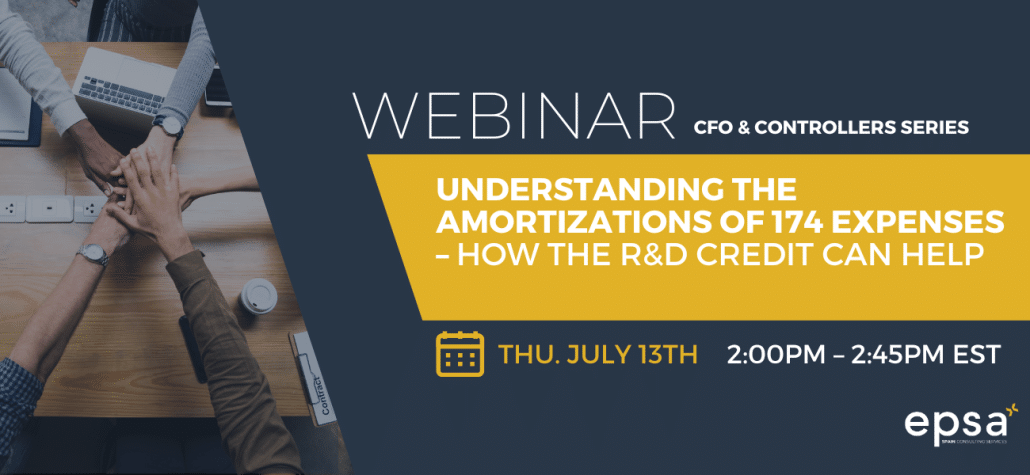

On July 13, we are inviting you to our webinar on Section 174 and how the R&D Credit can help you through it. Below you will find the details of the webinar.

As many of you are preparing to file your extended return or need a better understanding of the implication of the changes to Internal Revenue Code Section 174 that took effect with tax year 2022 is critical. Most industry professionals were expecting this change to go away by now, but we must face the very real possibility that this change isn’t going anywhere anytime soon.

We will discuss the major changes, how to best prepare for the next 5 years, and how to mitigate the initial increase in tax liability in 2022. If your company is part of the following industries, you likely have Sec. 174 expenses to consider:

- Manufacturing

- Software & Technology

- Engineering

- Architecture

Speakers :

Ashley Chikes (Director of Operations, EPSA USA)

Ashley is the Director of Operations for EPSA USA, the US subsidiary of EPSA, a global consulting firm. She works with businesses of all sizes, from pre-profit to $50+ B in revenue, to identify and calculate a research and development tax credit at both the federal and state level. Her industry experience includes software and technology, engineering, life sciences, architecture, and manufacturing. Ashley graduated from the University of Pittsburgh with a Bachelor of Science Degree in Finance and Marketing. She is also a licensed Pennsylvania attorney and graduated with her Juris Doctor from the University of Pittsburgh.

Jake QUAST (Senior Manager, EPSA USA)

Jake has a Bachelor’s degree in business finance with a pre-law Minor from Dominican University of California. He’s now the Senior R&D Consultant at EPSA USA, helping Architecture, Manufacturing, Oil and Gas, and Engineering firms claim research and development tax credits. He works with a team of experts, including tax attorneys and data analysts.

Mark Heath, CPA McKonly & Asbury

Mark is Director of Tax Services and provides strategic tax compliance and advisory services to our clients. His work is focused on Federal and State Income Tax Compliance for Corporations, Partnerships, and LLCs, Individual and Trust Taxation, ASC 740 – Accounting for Income Taxes – Calculation and Reporting for SEC Registrants and Privately-Held Companies; Outsourcing of Internal Income Tax Function.

Cannot attend ? A recording will be sent to all those registered !