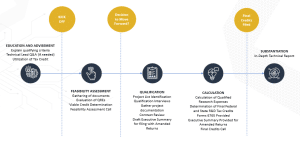

At EPSA, we redefine feasibility assessments to ensure our clients make informed decisions right from the start. Here’s a glimpse into how we deliver exceptional value through our meticulous process.

Kick-Off

- Conduct Kick-Off Call

- Prepare and send feasibility assessment document request

- Conduct follow-up document request call (if necessary)

The cornerstone of EPSA’s approach lies in our Feasibility Assessment. While many firms offer superficial estimates, we go the extra mile with a rigorous, quantitative study. An accurate Feasibility Assessment allows our clients to gain unwavering confidence in our estimates, underscoring our commitment to transparency and value.

Feasibility Assessment

- Gather and review documents

- In depth data analysis

- Conduct detailed interview with Client over potentially qualified expenses (employee wages, supplies, contractors, cloud hosting)

- Review sample project contract agreements (if applicable)

- Prepare robust calculation model

- Finalize feasibility assessment ranges after thorough review

- Conduct teleconference with client & CPA to go over comprehensive feasibility assessment ranges, which includes minimum and maximum anticipated R&D credit figures

- Confirm with Client how they would like to move forward & go over next steps to finalize the analysis

Qualification and Calculation

- Further vetting of project list data (time tracking, job costing, WIP report, etc.)

- Teleconference with client for project list vetting

- Detailed discussions on contractor, supply, and cloud hosting costs (if needed)

- Conduct Statistical Sample (if necessary)

- Provided final project list to client

- Gather project points of contact & contract agreements

- Schedule and conduct project qualification interviews

- Review contract agreements thoroughly & gather any necessary follow-up items

- Gather example project documents (i.e. Design iterations, mark ups, notes, etc.)

- Prepare and review final credits

- Quality and legal review of final credits

- Send final credits and filing forms to client and CPA

Substantiation

- Draft & Finalize technical reports

- Quality and legal review of technical report

- Provide client with final Substantiation report