What is the §179D Deduction?

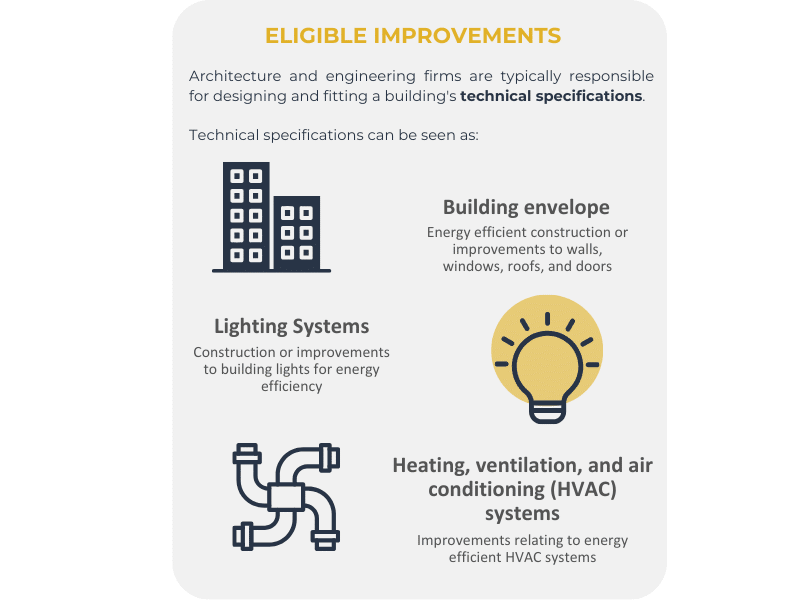

EPSA USA provides expertise in leveraging the §179D Deduction, also known as the Commercial Buildings Energy-Efficiency Tax Deduction. Enacted in 2005 by the Energy Policy Act, this deduction rewards Architects, Engineers, and subcontractors who undertake energy-efficient projects on tax-exempt or private-sector properties in the United States.

Under the §179D Deduction, companies can receive up to $5.00 per square foot for improvements that surpass current energy efficiency thresholds, following updates from the Inflation Reduction Act. This is a notable increase from the previous maximum of $1.88 per square foot for projects placed into service before 2022.

EPSA USA is dedicated to helping you maximize the benefits of this deduction, ensuring your projects meet the necessary criteria and securing the optimal tax savings for your business.