R&D Tax Credit

The Federal R&D Tax Credit

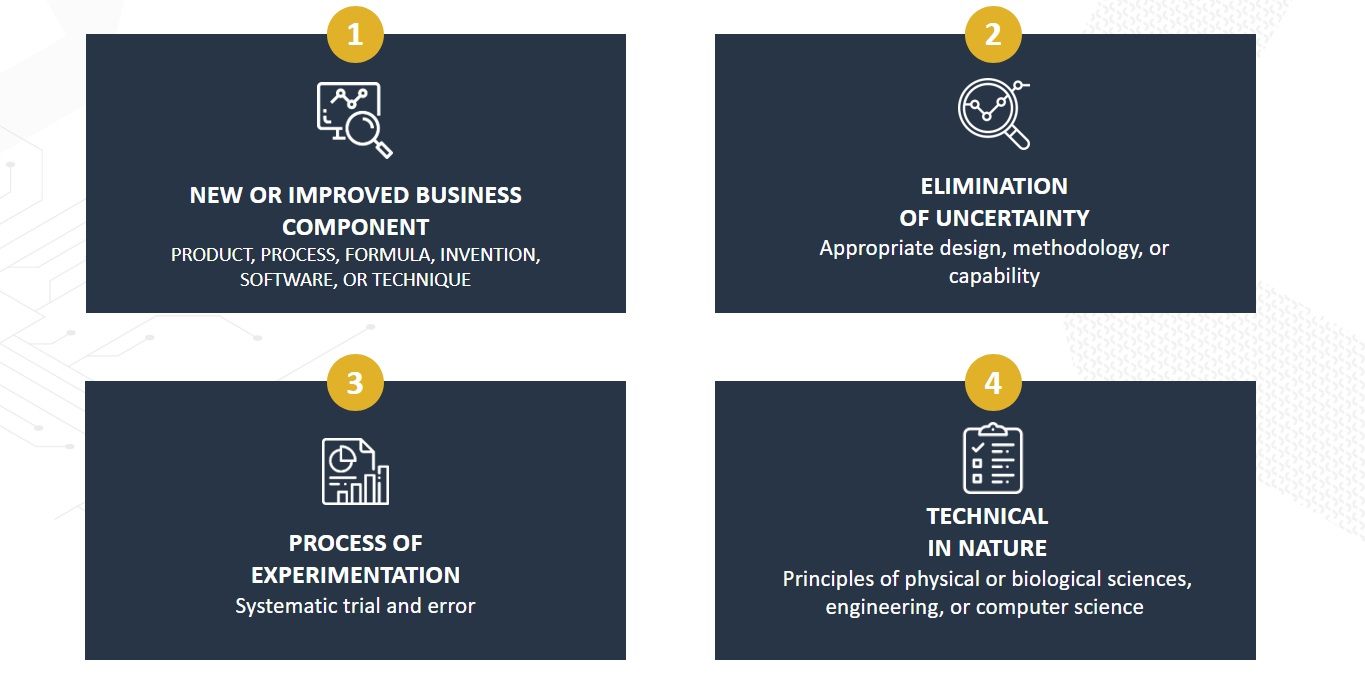

The Credit for Increasing Research Activities, more commonly referred to as the Research and Development (R&D) Tax Credit, was enacted in 1981 and made permanent in 2015 with the passing of the Protecting Americans from Tax Hikes (PATH) Act. The credit was enacted to encourage businesses to keep innovation in the United States and is available to nearly all industries – it is not just for companies that wear lab coats and develop patents.

The calculation requires an analysis of the current year expenses, as well as an analysis of at least the three prior year expenses (if available). The credit can be claimed for the current year and can be claimed retrospectively for any open tax years. Unused credits can be carried back one year and can be carried forward up to 20 years.

State R&D Tax Credits

Following the passing of the R&D Tax Credit at the federal level, several states also developed their own R&D Tax Credit. The qualification and calculation methodology varies based on each state, and can be claimed in addition to or independently from the Federal R&D Tax Credit.